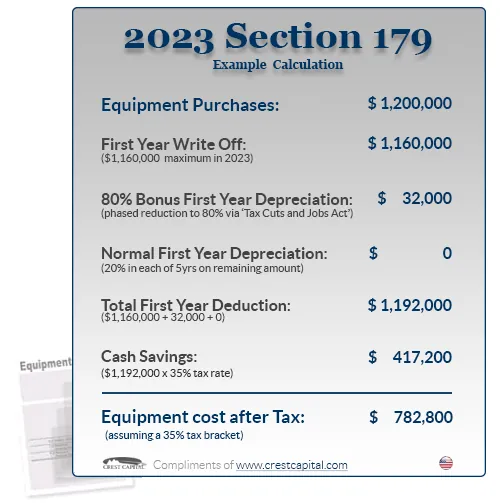

Section 179 Deduction Vehicle List 2024 Template – Property that qualifies for this tax break includes machinery, tools, furniture, fixtures, computers, software and vehicles. (This special rule often goes by the alias “the Section 179 deduction . After record-high used vehicle prices declined notably in 2023, pricing is expected to be relatively stable through the 2024 calendar, according to a report from Cox Automotive. The automotive .

Section 179 Deduction Vehicle List 2024 Template

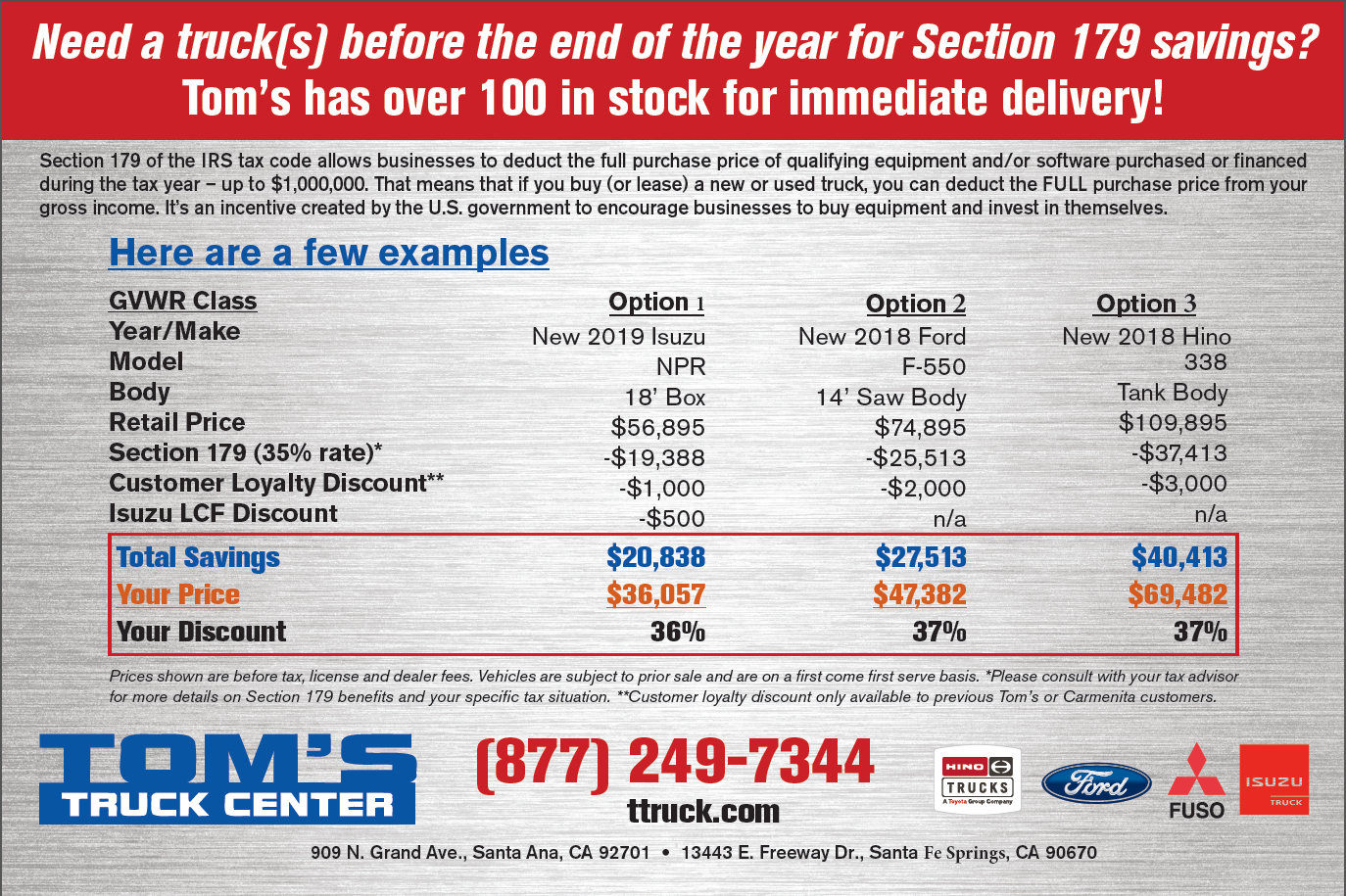

Source : www.commercialcreditgroup.comSection 179 Deductions! | Tom’s Truck Center

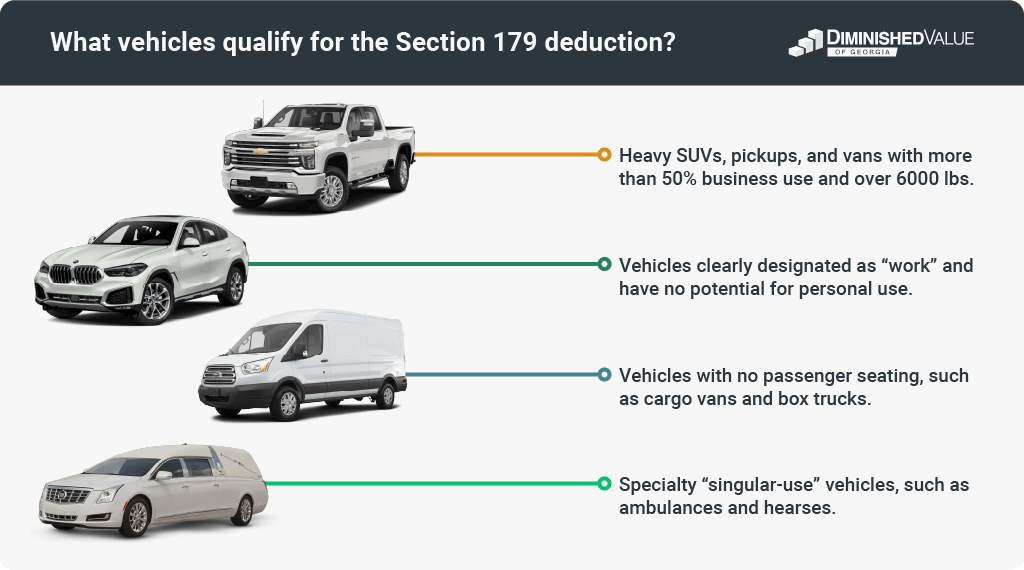

Source : www.ttruck.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

Source : diminishedvalueofgeorgia.comSection 179 Tax Deduction Vehicles List | Bell Ford

Source : www.bellford.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

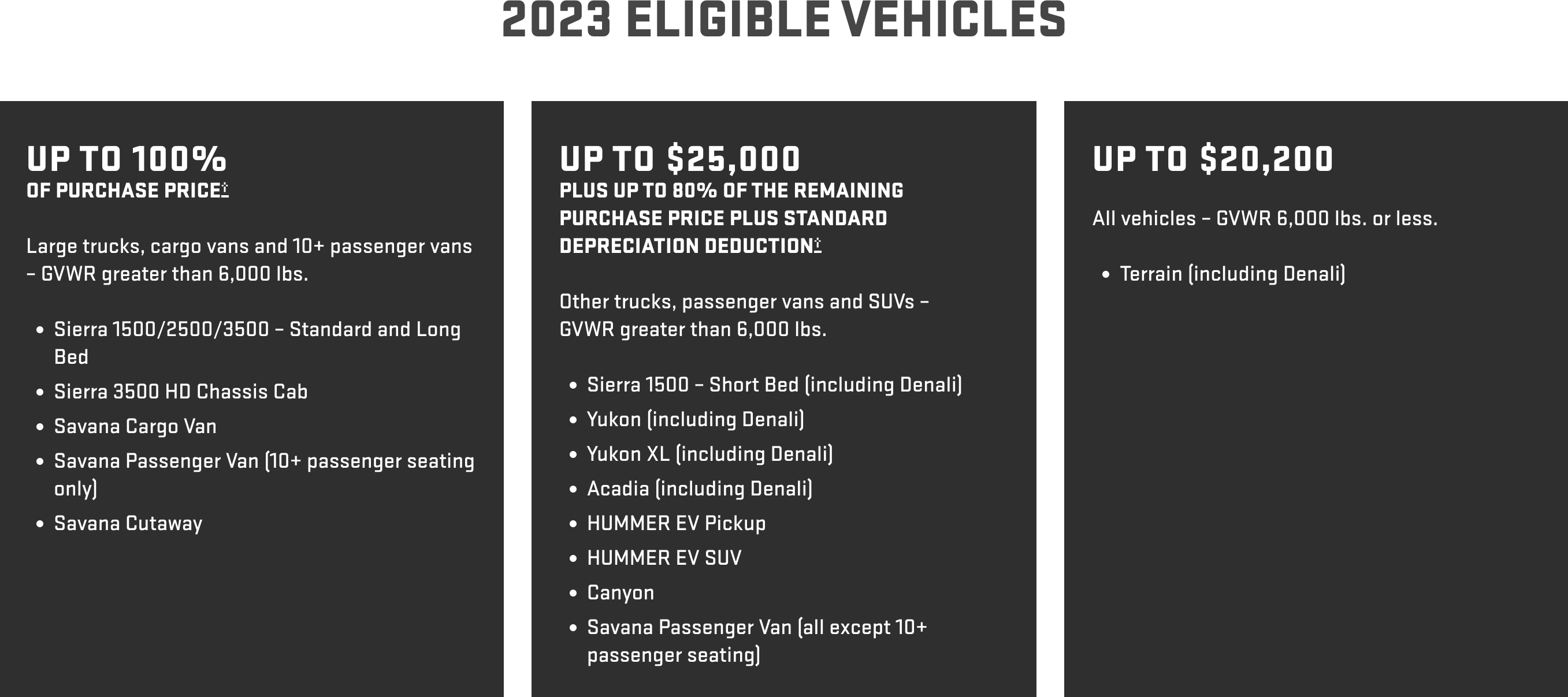

Understanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comHow To Deduct HVAC Equipment Purchases For Your Business With

Source : gopaschal.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comBEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

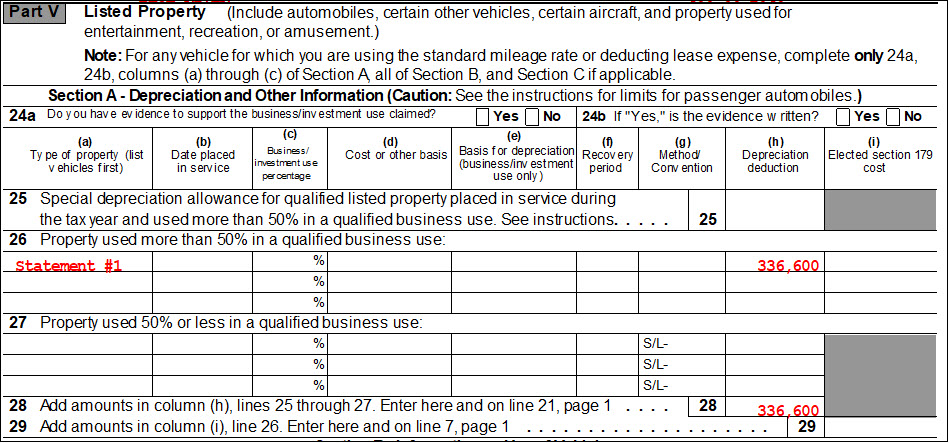

Source : m.youtube.com4562 Listed Property Type (4562)

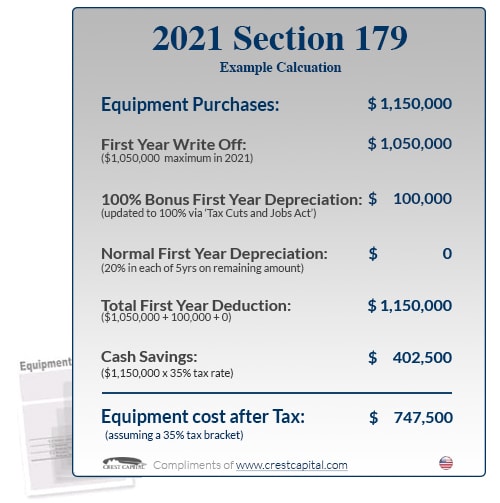

Source : drakesoftware.comSection 179 Deduction Vehicle List 2024 Template Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions: Consumer Reports recently surveyed its members to find the vehicles buyers were most unhappy with, and there are a few surprises on the list. The publication combined its vehicle ratings with . You have to understand the time period that regular depreciation allows as well as options for bonus depreciation or Section 179 deduction You purchase a vehicle for $30,000. .

]]>