2024 Form 1040 Schedule Dtdc – Schedule C (Profit Or Loss From Business) Form 1040 Schedule C is the main form that you must use to take your small business tax deductions. It contains a long list of categories for deductions . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule Dtdc

Source : m.facebook.comAmazon.com: Kleenex Balsam Extra Large Tissues in 16 Compact Boxes

Source : www.amazon.comTCI Express Ltd. (@tciexpress_official) • Instagram photos and videos

Source : www.instagram.comKitna Milega how to calculate amazon profit margin Amazon Profit

Source : m.youtube.comVFM Accounting & Bookkeeping Bahrain | Manama

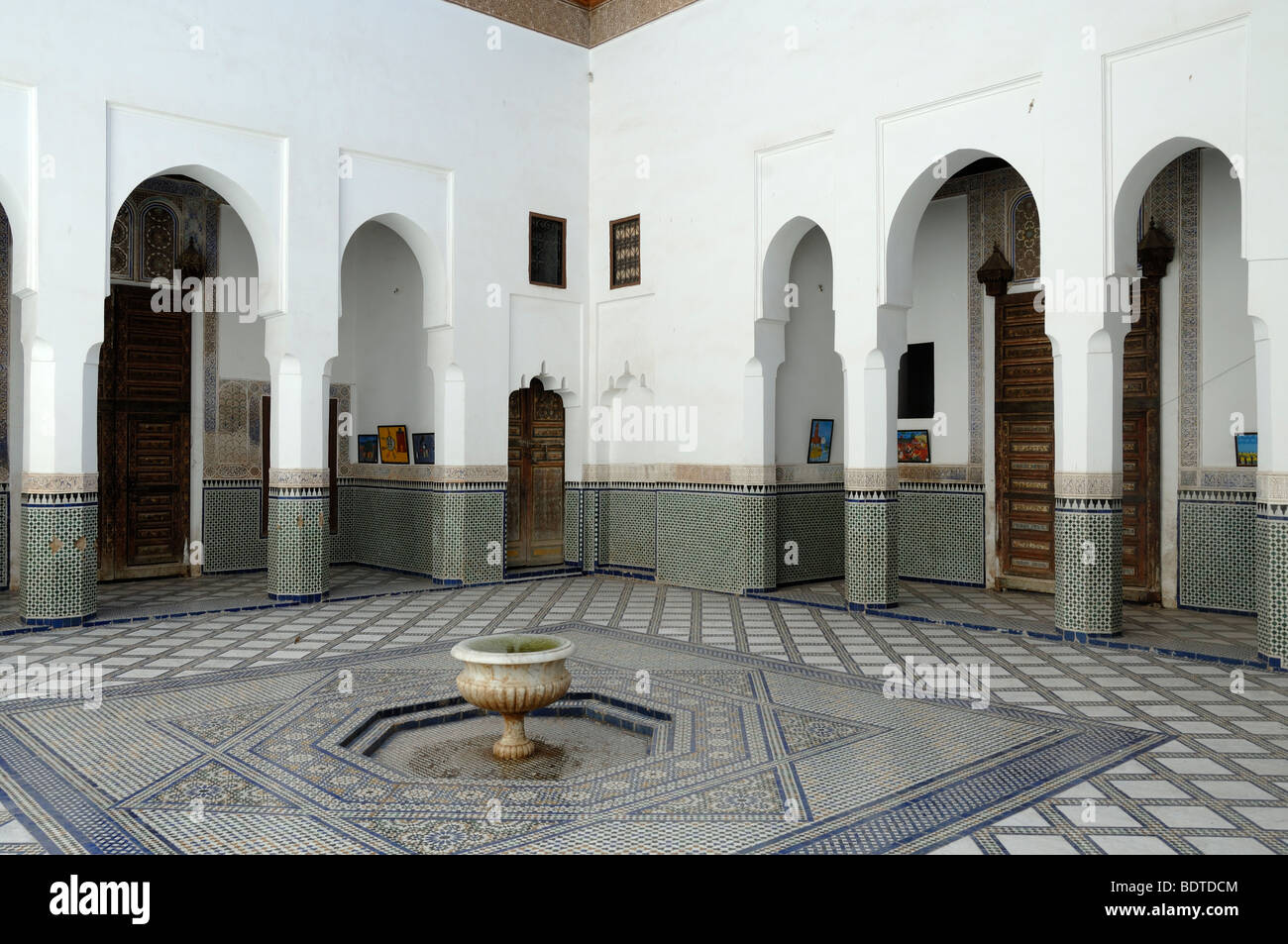

Source : www.facebook.comCourtyard fountain at marrakesh riad hi res stock photography and

Answered: Horizontal analysis (trend analysis)… | bartleby

Source : www.bartleby.comPromit G. Tax Associate Vialto Partners | LinkedIn

Source : in.linkedin.comHow to Start an LLC for Courier & Delivery Service Business (Step

Source : www.youtube.comPrabhat Gupta Tax Associate 2 RSM US LLP | LinkedIn

Source : in.linkedin.com2024 Form 1040 Schedule Dtdc Acme Stamp & Sign Co. | Orlando FL: Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

]]>